A seasoned investor can smell promise in a startup at a first meeting. Other times, founders execute a blowout performance that surpasses the wildest expectation of their reluctant funders.

But what does it really take for a startup to succeed?

In a new study published in the journal Science on Thursday, a duo of economists argue that a handful of few key factors seem to be associated with the potential for success — and they’ve developed a mathematical framework that lets them predict how the far a company or even a whole innovation cluster can grow.

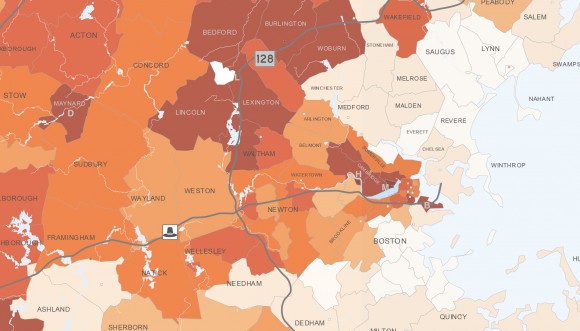

Nowcasting – Kendall Square_legend outside_no title

While most measures of entrepreneurial activity focus on the number of new startups in a region, what makes the new tool different is that it is an index of quality, claims Scott Stern, a professor at MIT’s Sloan School of Business and a co-author on the study.

None of the ingredients that go into this assessment are surprising. Names tend to be key indicators, for example — companies not named after their founders that have their names trademarked show potential. “You’re not going to name yourself Spotify unless you’re planning to grow,” Stern said

They also considered the history of entrepreneurship of the company’s founders, and its tally of media mentions (specifically, it they noted if it was mentioned in the Boston Globe). Intellectual property acquired in the first year mattered, as did the kind of incorporation and location of the firm’s headquarters.

These factors are “kind of like the DNA of the company,” said Stern. The new tool provides a mathematical lens through which to make sense of them. The scores could be used to assess the effect of zoning laws, for example, or the local impact of accelerator programs like TechStars.

SV-Map

As a demonstration, Stern and Jorge Guzman, a graduate student at Sloan, applied their analysis to the state of California. As expected, Silicon Valley came up with the highest scores. And although Los Angeles had the same number of new startups as the Bay Area, those in the Valley tended to show more potential.

To some extent, the tool is able to tease out the core DNA of a startup (things that could exist anywhere) from the local environmental factors that influence its ability to reach its potential. For example, the economists showed in the Science paper, that even when a company has all the right boxes checked (great name, intellectual property, a founder with a great history) the area where they decide to launch can be a determining factor in their success. Their findings showed, for example, that Los Angeles as a region underperforms.Mass_State-map

They also applied their analysis to Massachusetts. Using only information like firm names, intellectual property acquired, and whether they’d been incorporated as a legal entity in Delaware, they were able to back-calculate that Cambridge and Boston were the innovation hot zones of the state. (That confirmed their method worked — if their calculation had flagged Salem, or Ashland, we’d be surprised.)

Stern and Guzman presented their data on Massachusetts startups at a conference on entrepreneurship hosted by the National Bureau of Economic Research in December.

Among the startups he advises at Sloan, Stern said that Ministry of Supply and PillPack were examples of startups who had some of that magic DNA — though Stern remembers telling founder Kit Hickey that he thought name they’d picked was a tad too long. But it seems like it’s been working out for them.

Leave a Reply

You must be logged in to post a comment.