From: http://www.bizjournals.com/

It’s a volatile, uncertain, complex and ambiguous (VUCA) world out there.

A recent CGMA report found that about 60 percent of organizations face increasing and more complex issues than they did five years ago. Truly, now is the time to recognize the effect these conditions increasingly have on the market and take action.

Success in this climate calls for versatility and risk taking, with the goal of yielding positive results through collaboration and meaningful response to innovation, risk and disruption.

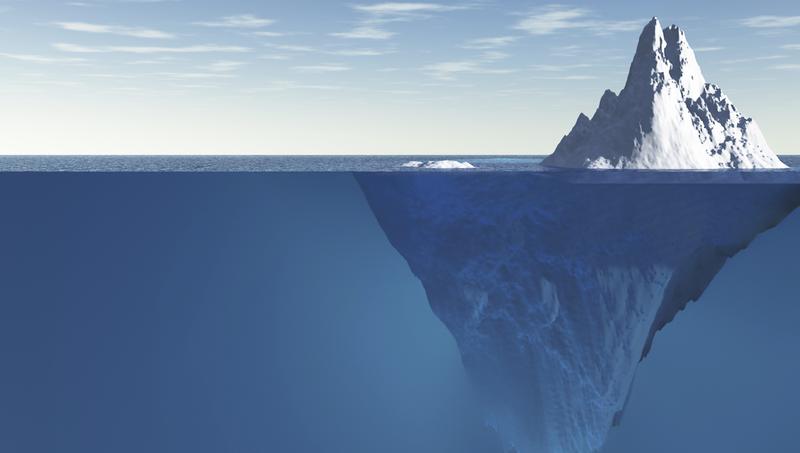

All complexities and risks can pose a threat to the business, even ones that may not seem to directly affect your organization on the surface. For example, a startup can emerge, seemingly overnight, that proposes a simpler solution to your established offering and disrupts your business model.

This type of volatility is no longer the exception to the rule. These disruptions, risks and uncertainties are par for the course.

Leveling Up the Business by Chasing the Opportunity in Risk

R isks come in two forms — financial and nonfinancial. Financial risks pertain to the monetary and quantifiable. Non-financial risks are traditionally seen as outside of the financial leader’s wheelhouse — think competitive risks, supply chain disruption or market innovation.

These types of risks also create opportunities. You cannot have business success without identifying an opportunity, funding it, and taking it successfully to market. To execute this optimally, the business needs to identify the challenge, or risk, at hand. More than ever before, the finance function is an essential part of the formula in creating a risk management strategy and responding to risk.

Assessing and Managing Risk — Identifying Opportunity and Pulling the Trigger

The finance function needs key competencies and skills in developing procedures to detect, assess, evaluate and mitigate exposure to business risk. They need to be able to provide advice on business continuity management and risk reporting systems, as well as interpret risk reporting. Finance should lead the development of innovative and strategic approaches to managing significant business risks across the organization, including implementing a strategy that will combat any risk factors that could adversely affect the organization’s priorities and goals.

To create opportunity, an organization must set a baseline and understand their appetite for risk. The finance function should be able to articulate the business risk in a manner that translates to financials. If you don’t know what your risk appetite is, you can’t be sure if a certain opportunity can become a business success.

For finance leaders to contribute to the organization’s successes through risk management, they must take the following steps:

- Have clear business goals that drive operations

- Detect relevant business risks in the market landscape

- Evaluate risks and their likelihood of affecting operations and success

- Create a strategy for risk mitigation by collaborating with other arms of the business

- Explain how risk can be mitigated in ways the business can understand

- Plan and measure risk mitigation progress and success

- Provide feedback and advice from monitoring and participate in effective decision making

Finance professionals need to get comfortable with understanding and managing risk rather than being risk averse, acting as the value and risk integrator for the organization. These risks are best anticipated and prepared for when finance is collaborating with other arms of the business to establish and plan for them — neither function should be working in a silo.

Remember, risk management is competitive advantage in this VUCA world. A finance function that is engaged in driving business results and engaged intimately in risk management will ensure that the business not only survives, but actually thrives.

Leave a Reply

You must be logged in to post a comment.