From: bostonglobe.com

This is Small Business Week, a time to celebrate and support the entrepreneurs who contribute to the vitality of communities all over America. Rockland Trust’s “Talking Business Advice Series” asked Robert H. Nelson, district director of the U.S. Small Business Administration, to discuss the health of small businesses in the region, trends companies should be aware of, SBA financing opportunities, and programs that give a boost to veteran- and women-owned ventures.

Q. At the start of Small Business Week, give us a benchmark on the health of small businesses in this region today.

Each year, Small Business Week nationally and in Massachusetts gives us the opportunity to thank and recognize an amazing lineup of small business successes and champions for what they do to build strong communities, the way they treat employees as family, and the way they give back over and over again in so many different ways. It truly is humbling to present our small business awards each year and this year is no different.

We’re coming off a very strong 2015 in this region, with positive indicators in several key areas. The SBA District office in Boston last year supported 2,667 loans for more than $657 million through three main loan programs.

Those figures show a steady three-year improvement. It’s good to see that we reached and then exceeded the pre-recession numbers of 2007.

Those loans supported a range of new and existing businesses and they have a real impact on the regional economy. We’ve seen that strength continue in the first quarter of 2016 and we’re hoping to keep the positive momentum building.

Q. Can you break those loans down by major recipient categories?

Certainly. Here are some quick examples:

- We saw 2,342 loans last year worth more than $330 million under SBA’s flagship 7(a) Loan Guaranty Program through 143 lenders. Under the SBA 7(a) program, the government provides a guarantee to the bank to help it get comfortable enough to get to the “yes” decision on the loan. SBA does not lend funds directly.

- In 2015, nearly 250 small businesses here received more than $325 million in capital support through the SBA 504 loan program. These loans provide up to 90 percent financing with below-market, fixed rate pricing, with the proceeds generally used to purchase owner-occupied business real estate. The most recent pricing of 4.31 percent fixed for 20 years is extremely attractive and is a win-win for the lender and small business concern. The 504 loans have as a key benchmark the number of jobs created by the respective projects and is truly an economic development loan program.

- 76 Bay State businesses got micro loans totaling more than $1.3 million through nine micro lenders.

Q. What does this distribution tell us?

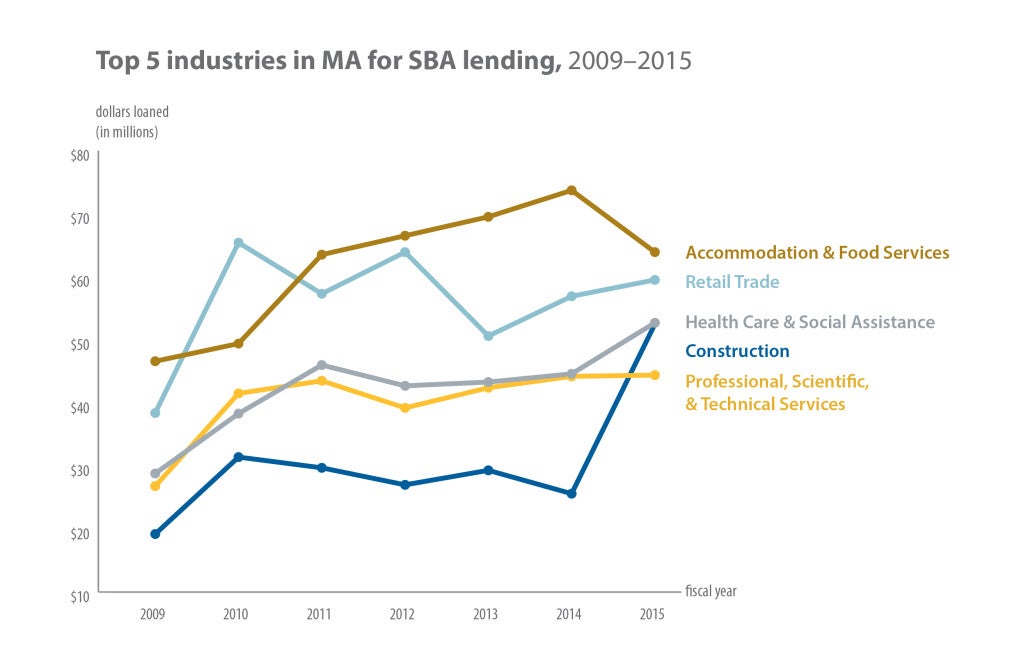

Every year, SBA loans in Massachusetts go to a wide array of businesses — from traditional mom-and-pop Main Street businesses, such as restaurants and retailers, all the way up to our high-growth, technology-oriented and focused concerns. Loans to businesses involved in the trades and construction are seeing very strong activity this year to date.

We also track who the recipients of SBA loans are and it is certainly encouraging to see increases so far this year in all underserved community markets, including loans to women-, veteran-, African American-, Hispanic- and Asian-owned businesses.

The trends that we’re seeing point to an economy that is expanding and growing jobs, with increased loans to construction trades, arts and entertainment, accommodations, the food service industry, and more loans to early stage start-ups with more and more lenders participating in this activity. This year to date, we have approved 308 loans to early stage businesses (two-years-old or less) vs. just 232 at this same time last year — an increase of 33 percent. These loans are being done by 77 various lenders across the state, so we’re very pleased with the strong increase and the number of lenders participating.

Q. What are micro loans, how much are we talking about, and who is getting them? Also, what are micro lenders? How do you get lenders interested when the return, at least initially, is so small?

Under the SBA micro loan program, SBA lends funds at very attractive pricing to micro lender intermediaries, who then lend funds directly to small businesses in very small increments up to a maximum of $50,000. Here in the Commonwealth, we have nine micro lenders in the program. In addition to the capital that microenterprises need to start and grow, the program also requires technical assistance to help ensure a better business survival success rate. SBA provides grants to the intermediaries so that they can deliver the critical workshops and to help build capacity in these very small businesses. Most of our intermediaries are mission focused, which is the motivation for helping out this segment of the capital spectrum.

Q. In addition to loans, are there any other baseline metrics that offer glimpses of growing small business activity?

Another indicator of economic growth is the number of people trained and counseled by the SBA and its resource partners – SCORE, the Massachusetts Small Business Development Center Network and the Women’s Business Center at the Center for Women & Enterprise. Last year, roughly 19,200 people got that free assistance. Through these partners, we ensure that entrepreneurs have access to the know-how and technical assistance they need to succeed.

As much as we market through a variety of channels, many folks don’t know about all of the services that are offered through the SBA. In fact, we have one of the most resource-rich states in America for small businesses.

I encourage small businesses to connect with all three resource partners. They will benefit from all of them and through the advice offered when critical decisions need to be made. The services are free of charge or at a very low cost. In addition to start-up help, small businesses can learn about marketing, social media, taxes, how to develop and deliver a perfect business pitch (to a lender or investor), how to do business with the federal government, and even how to get into exporting to increase sales. We have an amazing, passionate small business team here in the state ready to connect and deliver.

Q. There has been a great focus on the region’s innovation economy, especially since GE announced that it chose Boston for its headquarters. Do you see any hints of where the innovation economy is going here?

Our small businesses in Massachusetts benefit greatly from the SBIR/STTR programs (Small Business Innovation Research and Small Business Technology Transfer) and this state is certainly ranked at or near the top in terms of the number of grant recipients nationally.

Both of these programs offer grant opportunities for businesses as a way for them to bring cutting edge, high impact technologies to market in areas such as health care, the military and the environment. When you think of the number of research institutions here in Massachusetts and the high tech/defense and medical technology segments, it’s not surprising that our businesses take advantage of a greater proportion of these opportunities.

It is also exciting to see what is happening in various incubators and accelerators here in the state and through our very own InnovateHer challenge competitions. Over the past two years, four accelerators have received grant funding from the SBA, including: Smarter in the City in Roxbury; Fraunhofer Techbridge; Greentown Labs and Harvard’s Incite Health. In addition, just look to what’s happening in Roxbury with Roxbury Innovation Center, and one cannot forget Cambridge Innovation Center, MassChallenge, and Harvard i-lab, to name just a few more. There is real excitement here in the greater Boston small business start-up community.

Q. In what sectors are you seeing the greatest growth and, conversely, where are small businesses struggling?

According to data on www.SBA.gov, immigrants are entrepreneurial and are actually starting 28 percent of all new businesses in the U.S. It is one of the reasons SBA has launched our website titled “ Made it in America – CelebratingImmigrant Entrepreneurs” and an SBA 101 initiative to make sure “New Americans” have the resources and tools to succeed and compete effectively.

According to SBA Administrator Maria Contreras Sweet, “Immigrants are twice as likely to start a business, they’re twice as likely to file a patent. Today, immigrants employ one out of 10 employees…it is important to recognize the contributions that immigrant populations are making.”

While there is a lot of good SBA news here in the state, there continue to be gaps, and this is where SBA continues to play a vital role. We would like to see even more lending to underserved markets and there are businesses in Gateway cities that are still struggling. We also need to expand our portfolio of 8(a), Hubzone, and women-owned small businesses that sell to the federal government, and much more work is needed to grow capacity by these firms and to help them get contracts.

Q. The SBA keeps track of the number of new businesses that fail. What is the average lifespan of a new venture? What are the most common reasons for those failures?

In Massachusetts, in the second quarter of 2014, 5,905 establishments started and 4,789 exited. According to SBA data, the gaps between start-up rates and exit rates continues to widen, which is a very positive indicator here in the commonwealth.

According to historical data from SBA, about two-thirds of businesses with employees survive at least two years and about half survive at least five years.

SBA data does show that businesses that receive technical assistance from SBA’s partner network are more likely to survive five years or greater.

There are so many different reasons for business failures: health problems, divorce, death, natural disasters, partnership disputes, changing technologies, and an inability of small businesses to adapt. However, the primary reason for failure is lack of management expertise and industry experience on the part of the owner/operator. It is one of the reasons that SBA requires its lenders to comment on the management expertise of the borrower as part of the credit memorandum and application to SBA on loans of $350,000 or less. We want to make sure that the small business owner has the skills and expertise to successfully run a business.

Q. On the flip side, what are the most important things a new or expanding business needs to do to increase the odds of survival and success?

By far, the most important step a small business can take is to find a mentor. Of all of the many successful small business owners that I have heard speak on the topic, most have a mentor and mention the value proposition that the relationship provides. I think most will agree with me that this can be critical. Mentoring relationships come in various forms and can be one-on-one relationships similar to what SCORE offers, or they can be peer mentor groups, which we build through our Emerging Leaders program. We have also had very positive experiences and feedback through CEO mentor groups, which are facilitated by our Small Business Development Centers.

Q. What does SBA data show about veterans and their families starting businesses?

Our experience has been that many of our veterans look to entrepreneurship as a way to provide for themselves and their families after exiting the service. This was especially true during the economic crisis and our recent periods of high unemployment. Our data shows that veterans often have the skill set necessary to run successful small businesses and are actually natural entrepreneurs. Data also shows that if we can help a veteran to start or scale a small business, they are more likely to hire fellow vets.

Some of the national stats on vets and entrepreneurship are: Veterans are 45 percent more likely to be self-employed and, according to the US Census Bureau, around 2.4 million – or 9 percent – of all businesses are veteran-owned and generate over $1 trillion in sales.

It is critically important that we support the men and women who have served all of us with programs and training to promote veteran’s entrepreneurship and development. Our Boots to Business training program, which in this state is delivered at Hanscom Air Force Base, has been training transitioning members of the military since 2013 with our two full-day small business training curriculum. For veterans, National Guard, reservist, and spouses we also offer our Boots to Business Reboot curriculum. There are currently fee incentives in place for veteran-owned small businesses needing an SBA loan, where the fees for loans are either eliminated or cut in half depending on the size of the loan. I am very pleased with our work in this area in Massachusetts, with our loans to veterans up 62 percent year-to-date over last year.

Q. Same question about women-owned businesses in this marketplace. Are you seeing growth there?

We are also seeing explosive growth in women’s entrepreneurship here in the commonwealth and nationally.

Think back to 40 years ago. At that time, women owned just five percent of businesses. Today, they own over 30 percent.

We are also seeing another positive trend in the growth of women-owned businesses with greater than $10 million in revenues. So, while years ago many women-owned businesses were home-based and/or very small, women are now involved in the multitude of businesses that men are involved in. We are very fortunate in the state to have the Center for Women & Enterprise, a dedicated resource to help women entrepreneurs deal with the gaps and very real issues that are still present. They are a tremendous resource for workshops and offer a significant number of networking forums to grow customers and to connect.

Q. What is the easiest way for anyone interested to learn more about the programs you’ve discussed?

Please visit the SBA website at www.sba.gov and the Massachusetts SBA website at www.sba.gov/ma. We want to be your small business resource in the commonwealth.

Note: The SBA does not endorse the organizations sponsoring linked websites, and does not endorse the views they express or the products/services they offer.

Leave a Reply

You must be logged in to post a comment.